The Catallax Trust has been designed to support a number of different scenarios. I’m outlining each one of these in a different post over the next few weeks as we move toward the release.

Today we are going to talk about how to use a Catallax Trust to set up recurring giving to a charity of your choice.

The Catallax Trust allows for a benefactor to set up a fiat based monthly donation of crypto to their favorite charity.

For example, Annie wants to help out the Ethereum foundation but doesn’t want to just sign over a bunch of her ETH at one time. She puts 1,000 ETH into a Catallax Trust and wants $10,000 USD per month to go to the Ethereum Foundation over the next 24 months. She wants to maintain some control over this and be able to revoke her donation if the foundation is taken over by a bunch of miners and Proof of Stake is taken off the board. If the price of ETH fluctuates wildly one of two things will happen:

If the price of ETH goes up he the trust will pay out less ETH and at the end of the contact Annie will get her remaining ETH back at the end of the 2 year period

If the price of ETH goes down Annie the contract will auto adjust the payout down so that the cash flows continue for the entire two years.

Using a trust for donating to a charity has a number of advantages:

Charities know that the account that will be paying them is fully funded and that funds can’t be moved right before the next month’s payout.

The contract requires a 36 day waiting period if you are going to change the beneficiary of a trust. This Guarantees at least one month of lead time for charities to know that their funds available are going to go down in the next month.

Benefactors won’t have to worry about monitoring exchange rates on donation day.

Charities can monitor the account as the value of the denominated crypto fluctuates to make sure that they plan well if crypto price crash.

Benefactors avoid the tax implications of converting crypto to fiat. The burden of doing so is transferred to the charity that may benefit from tax exemptions.

Creating the Trust and Assigning it to a Charity requires the following steps:

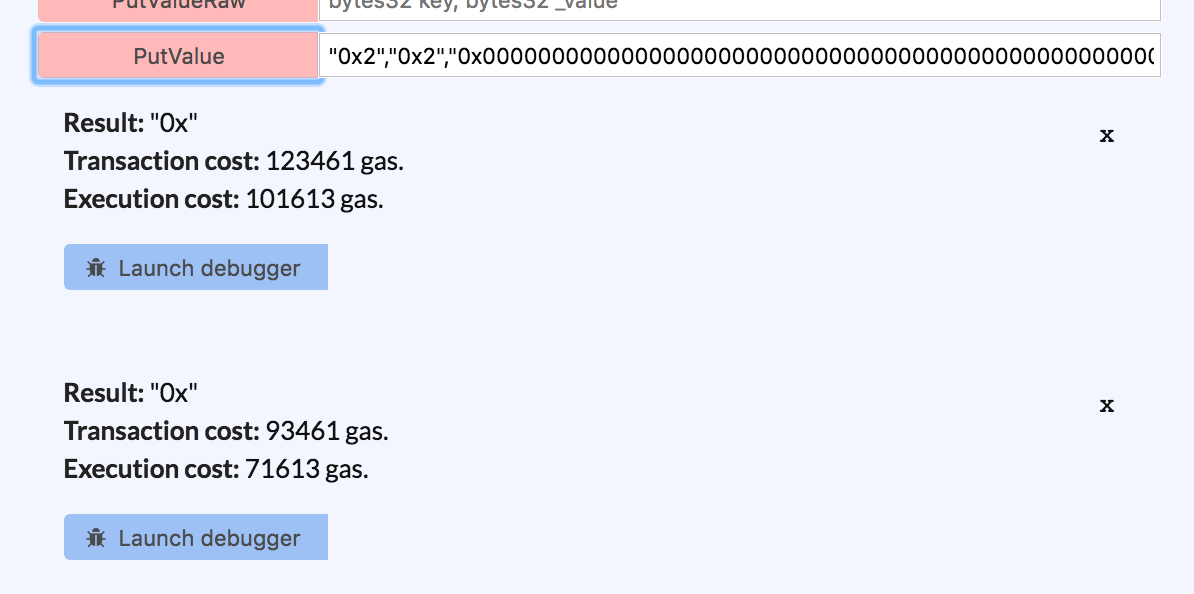

Benefactor calls the Custodian.CreateTrust function to create a new Catallax Trust contract. This function takes a token(ETH or ERC20), a currency(USD, EUR, ect.), term(number of months), and fiat payout(amount of currency per term to pay out).

Employer calls the Trust.ChangeBeneficiaryOwner function to set the beneficiary of the trust to the charity’s address.

Benefactor funds the Trust by sending ETH and or ERC20. Fees are paid in ETH, ERC20 can be required if the trust pays out ERC20.

Benefactor starts the trust on the first day of the contract by calling the Trust.StarTrust function.

During the month the Custodian will be publishing the exchange rates between the token and the currency to the blockchain.

After one month the charity can call the Trust.Withdraw function to get the exchange rate adjusted amount of crypto sent to their beneficiary address.

If you are interested in using a Catallax Trust to manage your employment contracts please reach out to us so that we can make sure that we support the Token / Currency combinations that you would like to use.

Please head over to this thread on our Reddit to pick the white paper apart and ask questions. You can download the Catallax Trust white paper here.

If this is interesting to you and you'd like to see where we are going with Catallax, please pick up my book Immortality (Purchase of a physical or kindle copy helps support this project).

Donations always accepted at:

BTC: 1AAfkhg1NEQwGmwW36dwDZjSAvNLtKECas

ETH and Tokens: 0x148311c647ec8a584d896c04f6492b5d9cb3a9b0

If you would like more code articles like this please consider becoming a patron on patreon.

You can discuss this article and more at our reddit page r/Catallax.